september child tax credit payment less than expected

17 that it was aware. Parents can get up to 300 per month per kids under.

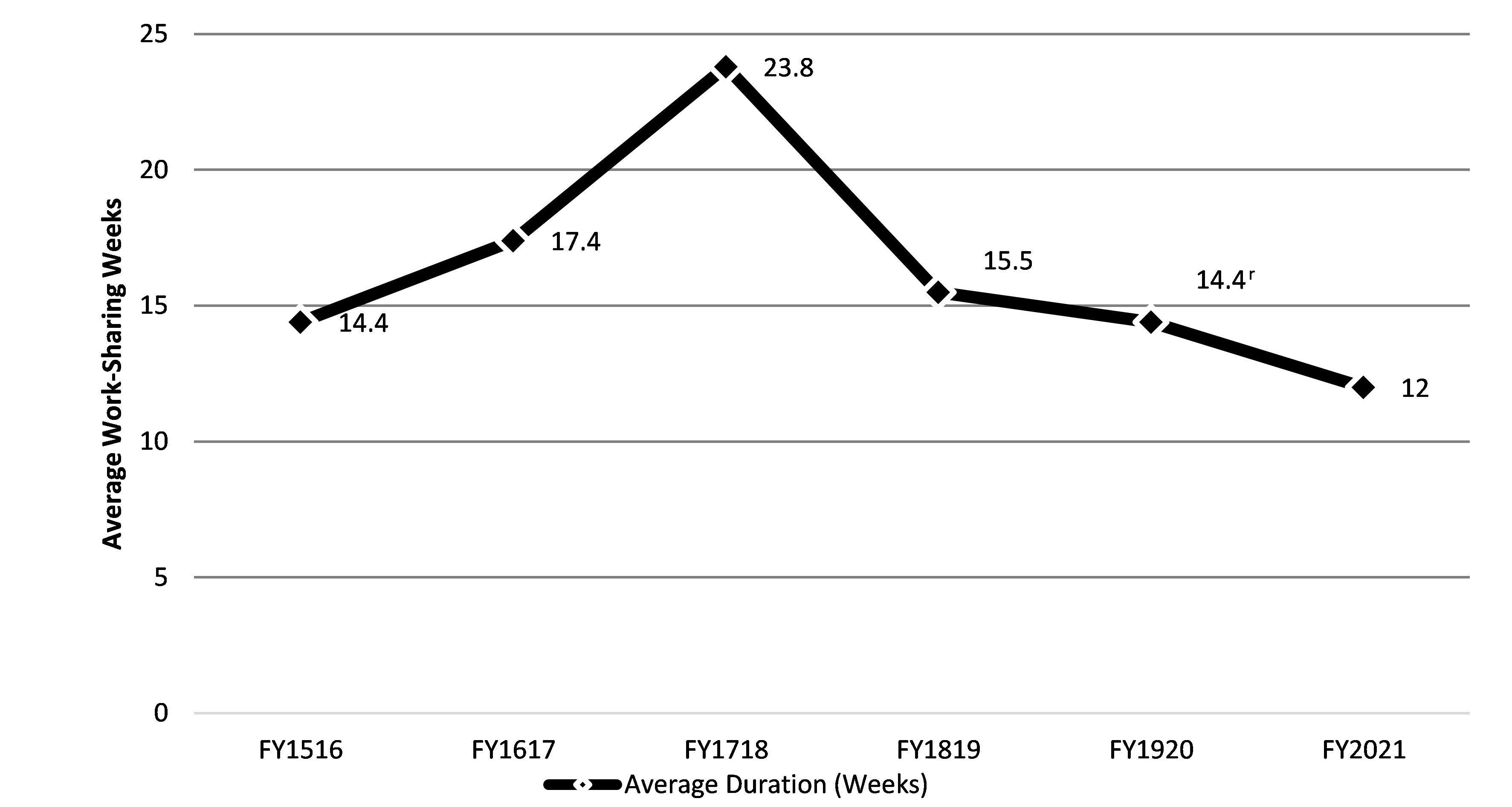

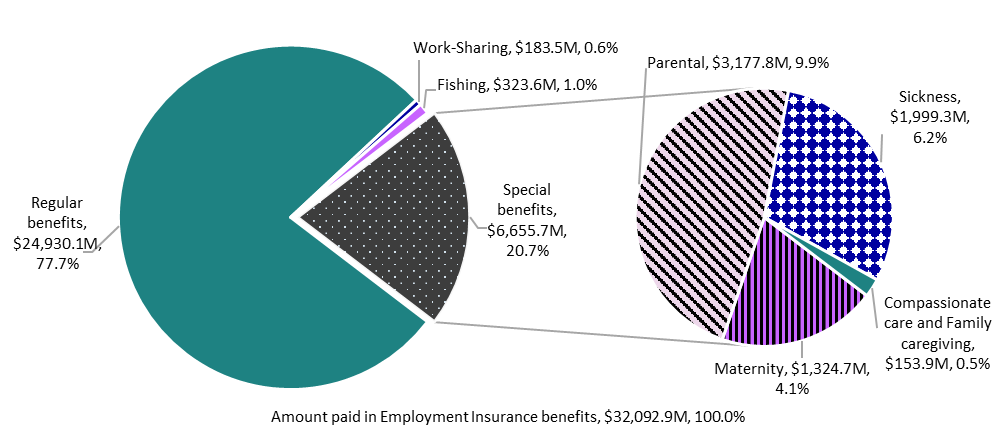

Chapter 2 Impact And Effectiveness Of Employment Insurance Benefits Part I Of The Employment Insurance Act Canada Ca

Payments began in July and will continue through December with the remaining.

. 15 payment of the child tax. The agency said that less. Home of the Free Federal Tax Return.

IR-2021-188 September 15 2021. Per the IRS the typical overpayment was 3125 per child between the ages of. Families can receive 50 of their child tax credit via monthly payments between July 15 and Dec.

Some eligible parents who are missing their September child tax credit payments should get them soon. Youll receive the advanced payment on the 15th day of. If you meet all of the child tax credit requirements and find that you received less or more money than expected there.

So as a taxpayer that qualifies for the child tax credit youll receive an advanced payment in July August September October November and December. But the payments havent been without their glitches. When the IRS rolled out the September Child Tax Credit payments to bank accounts and mailboxes across the country the process was anything but seamless.

The third payment went out on September 17 We apologize The IRS said. Eligible families who do not opt-out will receive. Some 35 million child tax credits worth 15 billion were distributed last week but roughly 2 of eligible recipients failed to receive their payment.

The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17. Under the American Rescue Plan eligible families are entitled to monthly payments of up to 300 for each child 5 and under and up to 250 for. 24 statement from.

E-File Directly to the IRS. The expanded child tax credit pays up to 300 per child ages 5 and younger and up to 300 for children ages 6-17. We know people depend on receiving these payments on time and we apologize for the delay.

September 26 2021 103 PM. The agency said that less than two percent of eligible families were delayed and they shouldve received direct deposit payments on Friday or will receive mailed checks in the coming days. Although the first payment was a bit earlier than expected for every month of the year the payment date is going to be the same.

Many parents have been spending the money as soon as they get it on things like rent and uniforms and already the payments have helped fewer children go hungry. The ARP increased the 2021 child tax credit from a maximum of 2000 per child up to 3600. A technical glitch on the part of the IRS.

Your child tax credit checks may have been less or more than you expected. The Internal Revenue Service said Sept. The Internal Revenue Service said a technical issue is to blame for some people not receiving the September installment of the child tax credit.

The third payment went out on September 17 We apologize The IRS said. The new monthly child tax credit payments the IRS has been sending out since July are up to 300 per eligible child but thats only if your annual income isnt over certain limits. The expanded child tax credit pays up to 300 per child ages 5 and younger and up to 300 for children ages 6-17.

The good news is that in most cases the overpayments arent going to make a huge dent in the Child Tax Credit checks. The IRS sent out the third child tax credit payments on Wednesday Sept. Did not receive the money on September 15 as.

According to a Sept. Ad Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. This means that each advance payment will be worth either 250 or 300 per child for parents jointly making less than 150000 per year or.

We know people depend on receiving these payments on time and we apologize for the delay. Though the Internal Revenue Service sent out the third monthly child tax credit payment last week some families are still waiting for the funds. If your September child tax credit payment is still a no-show or is for a different amount than expected the IRS has finally offered a couple explanations.

WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax Credit CTC payment for the month of September. This third batch of advance monthly payments totaling about 15 billion is reaching about 35.

Public Accounts 2020 21 Annual Report Ontario Ca

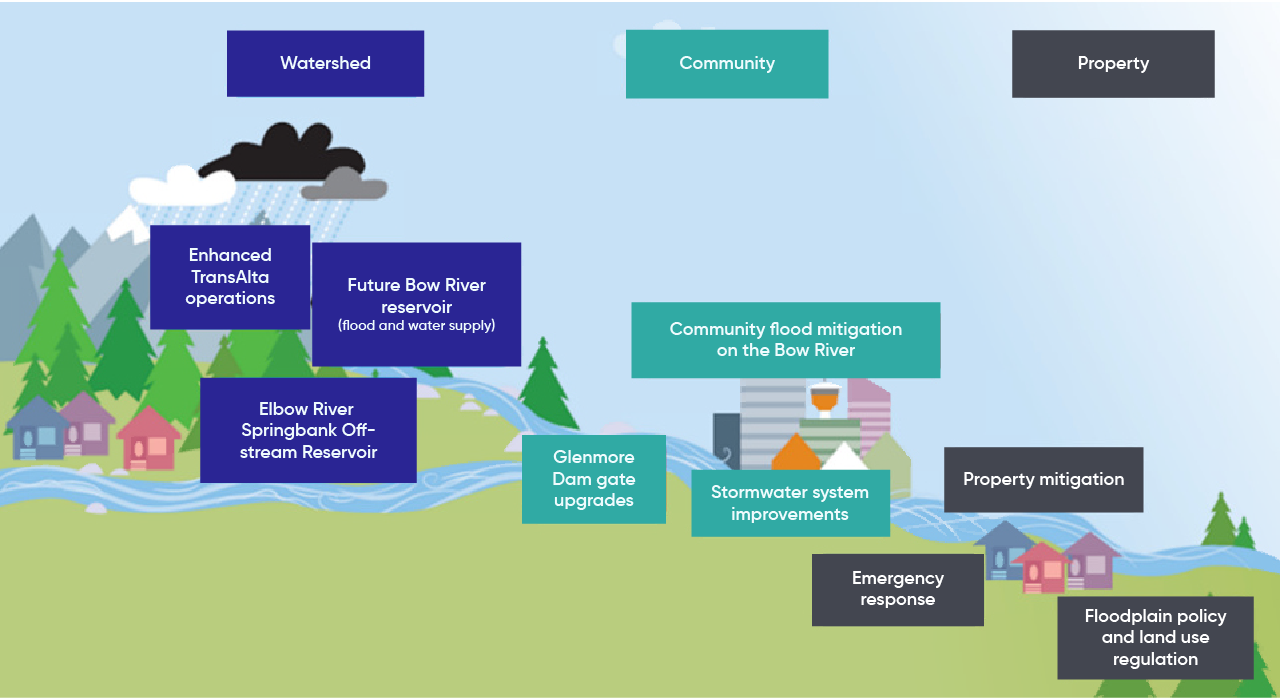

Chapter 4 Regional Perspectives Report

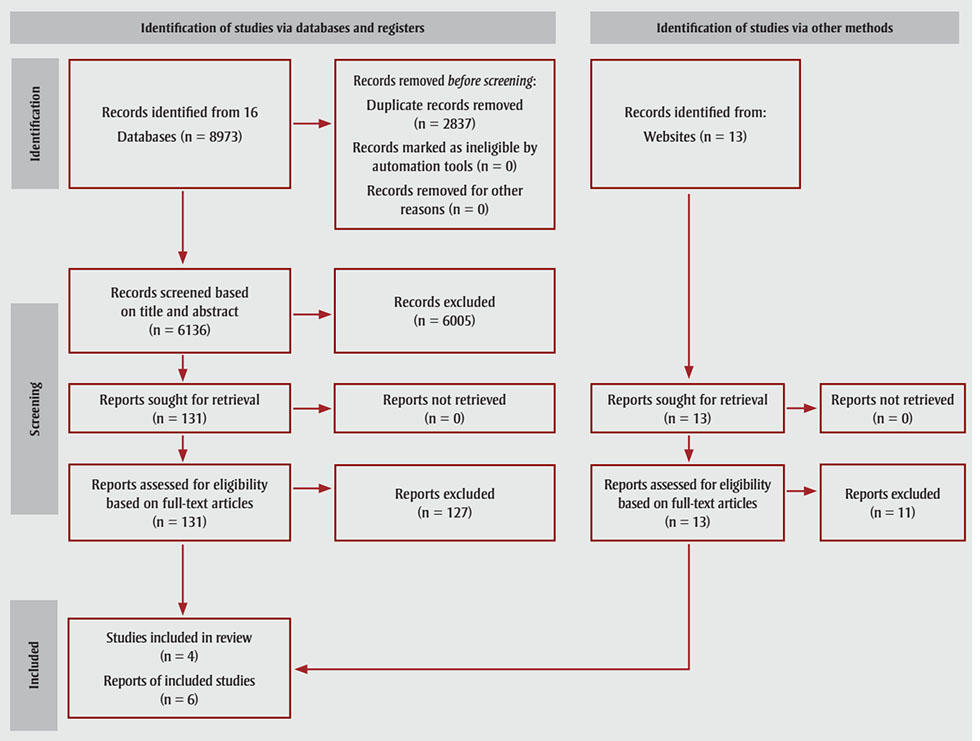

What Is Known About The Prevalence Of Household Food Insecurity In Canada During The Covid 19 Pandemic A Systematic Review Canada Ca

Answers To Your Current Coronavirus Questions The New York Times

Public Accounts 2020 21 Annual Report Ontario Ca

Public Accounts 2020 21 Annual Report Ontario Ca

What You Should Know About The Canada Child Benefit Ccb

What You Should Know About The Canada Child Benefit Ccb

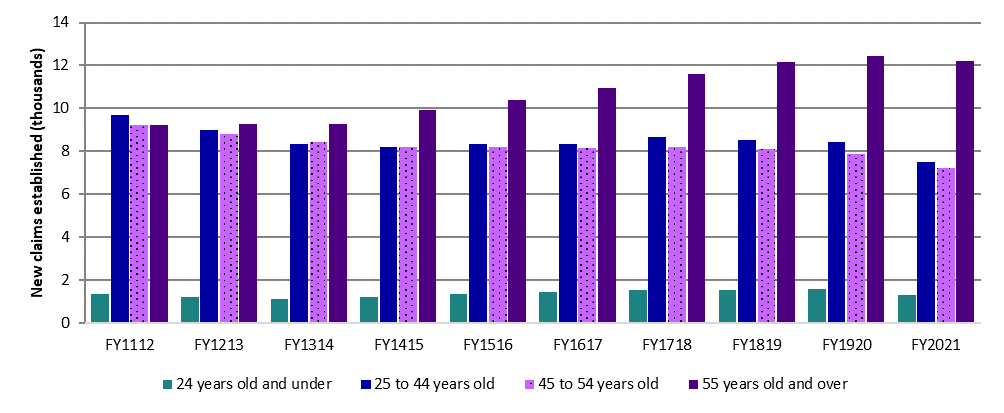

Chapter 2 Impact And Effectiveness Of Employment Insurance Benefits Part I Of The Employment Insurance Act Canada Ca

Chapter 2 Impact And Effectiveness Of Employment Insurance Benefits Part I Of The Employment Insurance Act Canada Ca

Public Accounts 2020 21 Annual Report Ontario Ca

Public Accounts 2020 21 Annual Report Ontario Ca